2018 Tax Law Changes for Individuals

Understanding the Tax Cuts and Jobs Act

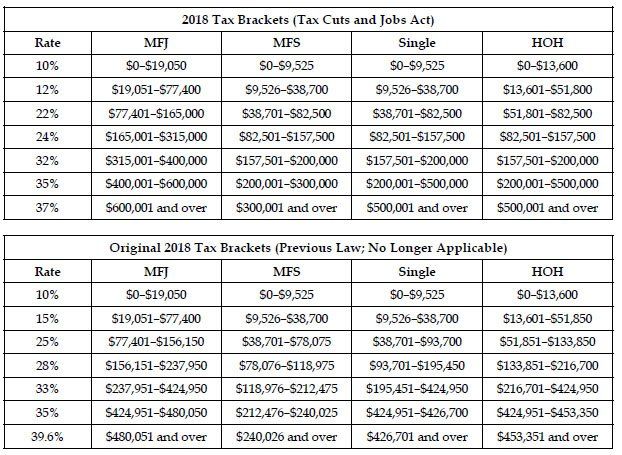

Tax Bracket Reorganization

Above the Line Deductions

Moving deductions and reimbursements —suspended through 2025 except for military service members who are changing duty stations. Employer reimbursements (other than military) will be included as taxable wages

Alimony —for agreements or modifications entered into after 12/31/18, alimony will no longer be deductible by the payer, nor will it count as income to the recipient. For a pre-2019 divorce, the old rules apply (payer can deduct payments and the recipient must pay taxes on them. The law does permit ex-spouses to modify an earlier divorce agreement to adopt the new rule after it goes into effect in 2019, but both spouses would need to agree to the change

Educator expenses —there is no change to the law where a teacher is allowed to deduct up to $250 paid out of pocket for classroom supplies and professional development courses

Dependent care —there is no change to the law. An employee can exclude up to $5000 per year from their gross income to provide for dependent care assistance.

Education Provisions

All education provisions remain the same for the following:

- American Opportunity Credit

- Lifetime Learning Credit

- Coverdell Education accounts

- Higher Education interest

- Employer provided education assistance

- Exclusion of qualified tuition reduction

- Exclusion for interest on US savings bonds used for higher education expenses

The only exception is the 529 plan, which now allows for the tax-free withdraw of funds if used for qualifying expenses for K-12 private and religious schools.

Tax Credits and Exemptions

Exemptions –the $4050 exemption per person (taxpayer, spouse, dependents) has been suspended

The Child Tax Credit –expanded to $2000 per child under the age of 17. More taxpayers will qualify for this deduction, as the phase out now begins at $200,000 AGI for single filers or $400,000 for MFJ filers

Non-Child Dependent Credit –allows for a $500 credit per non-child dependent. The same income phase out as the Child Tax Credit applies

Electric Vehicle Credit —credit has been retained and continues to be a maximum credit of $7,500

Adoption Credit —credit has been retained and continues to apply to an adopted child under the age of 18, with a maximum credit of $13,570

Alternative Minimum Tax

While AMT was retained, the exemption phase out has increased substantially. Old tax laws were $160,900 for Married Filing Joint, $80,450 Married Filing Separate, $120,700 single or Head of Household filers. NEW laws are $1 Million for Married Filing Joint, and $500,000 for all others

Standard Deduction and Itemized Deductions

Standard deduction has nearly doubled :

- Single filers = $12,000 deduction (up from $6,350)

- Head of Household filers = $18,000 (up from $9,350)

- Married Filing Joint = $24,000 (up from $12,700)

Itemized Deductions

Medical deduction has been retained and improved —for 2018, the threshold for deductibility is now 7.5% of Adjusted Gross Income (used to be 10% of AGI)

Itemized deduction phase out —the deduction limitation phase out for higher income taxpayers has been suspended

SALT (State and Local Tax) deduction —the SALT deduction has been capped at $10,000. This is a combined total of your property taxes + state/local taxes + DMV fees. In the past, the deduction was not limited

Mortgage interest deduction —full interest deduction allowed for up to $750,000 of indebtedness on primary/secondary home mortgage. For loans originated prior to 12/15/17, mortgage indebtedness can be as much as $1 million to qualify for full interest deduction. Home equity (includes second mortgages) mortgage interest can still be deducted so long as funds from the equity loan was used to buy, build, or substantially improve the home that secures the loan. The total of all loans must not exceed $750,000 ($1 million for loans originated prior to 12/15/17)

Charitable contributions —the deduction amount has increased, but charitable contributions cannot exceed 60% of a taxpayer’s AGI (up from 50%)

Miscellaneous deductions (subject to 2% of AGI) —miscellaneous deductions have been suspended through 2025. Some examples of these types of deductions are unreimbursed employee business expenses, union dues, tax prep fees, investment expenses, casualty losses

Affordable Care Act

The shared responsibility payment (penalty for not having health insurance) has been repealed and will go into effect in 2019